- Featured

- Clean air

- Climate justice

- Consumer Rights

- Corporate Accountability

- Data access

- Early Childhood Development

- Economic fairness

- Education

- Electoral fairness

- Environmental justice

- Food justice

- Gender based violence

- Grants/social assistance

- Health

- Housing and infrastructure

- Industry interference

- Land Justice

- LGBTQIA+ rights

- Media/ information access

- Public transport

- Racism

- Reparations

- Safety

- Sanitation

- Service Delivery

- Sexual and Reproductive Rights

- Social justice

- Unemployment

- Womxn's rights/ gender equality

- Workers' rights

- More

-

Decriminalise Medical Assistance in Dying (MAiD)Currently, our common law regards MAiD as no different from murder in cold blood. This is quite wrong, on both a personal level and as public policy. On the contrary, we regard doctors as caring and compassionate when they enable a competent patient, who voluntarily requests assistance with dying on account of unbearable and intractable suffering, because of disease or injury, to die a dignified death. Hence, with this petition, we wish to show solidarity with DignitySA’s High Court application because we believe that MAiD: • Is an act of compassion motivated by basic ethical values of equality, dignity, freedom of choice, and life; • Is a constitutional right grounded in the rights to equality, human dignity, bodily and psychological integrity (which includes the right to security in and control over one’s body) and freedom and security of the person in our Constitution’s Bill of Rights; and • Should therefore be recognised as a legitimate medical option at the end of life, or when suffering becomes intractable and unbearable, thus locating MAiD on a continuum with palliative care. #DecrimMAiDinSA #DignitySA #OurLivesOurChoices www.dignitysouthafrica.org345 of 400 SignaturesCreated by DignitySA

-

Provide Capricorn District Villages With Indoor Residual Spraying Once a YearPeople in the Capricorn district continue to experience discomfort and poor living conditions due to uncontrolled mosquito infestations. The municipality must take urgent action to provide proper mosquito control and improve conditions in the district. The Limpopo Department of Health recently advertised spray operator posts;[3] only 12 positions were advertised for the Capricorn district, which has over 400,000 households. While it is understandable that the Department of Health prioritises Mopani and Vhembe because they experience higher malaria cases, this focus overlooks challenges faced by other districts. The Capricorn district may not be suffering from malaria outbreaks, but it continues to live with severe mosquito infestations that affect their daily lives and comfort, which is not okay. “I have to use some of my grant money to buy mosquito repellent products, which won’t even last me a month”, these are the words of an elderly woman, Maggie Malebana from Moletjie, a village outside Polokwane. “Over 20 years ago, we used to have spray operators come to our homes to get rid of mosquitoes,” She added. Indoor Residual Spraying (IRS) has been one of Limpopo’s most effective ways to fight mosquito infestation for many years. The programme was introduced in 1932 and expanded in the 1990s through the Department of Health’s Malaria Control Programme.[4] Trained spray operators went door-to-door to spray once a year before the rainy season. Today, the IRS is limited to certain areas, leaving other districts, such as Capricorn, exposed to mosquito infestations that still affect people’s daily lives and wellbeing. The Free State Department of Health is investigating a malaria outbreak in Luckhoff, an area that is considered non-endemic. This should demonstrate that mosquito infestations will eventually lead to malaria, even in areas considered “non-endemic”.[1] The mosquito problem in the Capricorn district is not something that households can control with sprays and repellents; it is an infestation that requires measures on a larger scale to address through proper vector control measures.[2] The Capricorn district municipality must fulfil its responsibilities and ensure that every household receives Indoor Residual Spraying to prevent mosquito infestations. The municipality must recognise that mosquito control should not only be linked to malaria prevention but also to improving the overall living conditions of all Limpopo residents. [1] Health Authorities Investigate Malaria Outbreak In Free State, Luckhoff Area. Mmangaliso Khumalo for Jacaranda FM, 14 October 2025. [2] Limpopo Department of Health's Mosquito Infestation Warning Statement, 29 January 2025, Facebook [3] Limpopo Department of Health Spray Operator Positions, 18 August 2025 [4] Summary of Indoor Residual Spraying (IRS) In South Africa, Africa Fighting Malaria2 of 100 SignaturesCreated by Rina Lekoloane

-

We demand strong community voices in health governance!Every one of us relies on clinics — whether for ourselves, our children, our elders, or our neighbours. But too often, clinics don’t work the way they should. Patients wait for hours. Medicines are out of stock. Buildings are broken. Staff are overstretched. And communities are left out of the conversation. That’s where Clinic Committees come in. Clinic Committees are made up of community members who volunteer their time to help improve clinic services, hold health authorities accountable, and make sure everyone’s voice is heard. They are supposed to be the bridge between the clinic and the community — but right now, many of them are being ignored, under-supported, or even shut out. There is no strong national policy that protects their rights or gives them the tools they need to do their work. We know that when Clinic Committees are active and supported, clinics work better. Staff and patients talk more openly. Community health challenges are addressed faster. Real change happens from the ground up. That’s why we’re demanding that the Minister of Health adopt a clear national policy to define, support, and protect Clinic Committees across the country. We’re building a people-powered campaign to show that Clinic Committees matter — and that communities demand a voice in how public health is run. If thousands of us sign and share this petition, the Minister will have to act. Add your name and help show that health governance belongs to all of us — not just a few behind closed doors.2,130 of 3,000 Signatures

-

Godongwana forced to scrap VAT hike. Tell him to increase Sugary Drinks TaxHealth activists, everyday people, and health experts have gathered year after year to demand an increase on the Sugary Drinks Tax. It’s time that Godongwana and Treasury listen! Every year that Treasury delays increasing the Sugary Drinks Tax to its most effective 20% rate, it chooses to lose R2.7 billion in revenue, money that the country desperately needs. The sugar industry has tried different tactics to delay and scrap the Sugary Drinks Tax. They even went as far as to exaggerate statistics regarding claims that the Sugary Drinks Tax causes job losses, when research from Trade and Industry Policy Strategies found otherwise [1]. We call on Treasury and Minister Godongwana to finally listen to us and increase the Sugary Drinks Tax. You cannot continue to put industry profits before people’s health. References [1] Researchers challenge cane growers’ claims that sugar tax killed jobs, by Tamar Kahn for Business Day, 11 June 202444 of 100 Signatures

-

Team Steenhuisen, do your homework on Sugary Drinks Tax!We know big sugar businesses have a history of misinformation to try to protect their profits [4]. Just like tobacco, sugary drinks are a major threat to our health and are contributing to the Non-Communicable Disease crises we are facing. We cannot allow greedy big businesses to bully government and capture politicians to protect their profits. Big business and its associates continue to use their enormous resources to delay, dilute, and delegitimise decisions that are in the public interest. They have proven time and time again that they are bullies and continuously hold the country hostage with threats of job losses and divesting. [1] https://www.da.org.za/2024/11/da-submits-tax-reform-proposals-to-bolster-growth-and-jobs [2] https://theconversation.com/new-research-shows-south-africas-levy-on-sugar-sweetened-drinks-is-having-an-impact-158320 [3] Researchers challenge cane growers’ claims that sugar tax killed jobs. By Tamar Kahn for Business Day. 11 June 2024. [4] SA’s proposed sugar tax: claims about calories & job losses checked: https://africacheck.org/fact-checks/reports/sas-proposed-sugar-tax-claims-about-calories-job-losses-checked41 of 100 Signatures

-

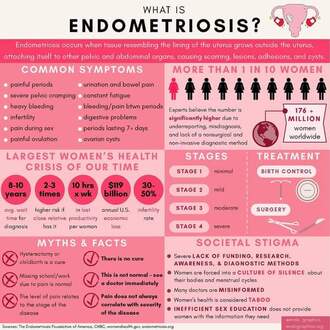

Tell South African Government to prioritize Endometriosis patientsIt is extremely important because for too long young girls and women have suffered this chronic disease without getting medical assistance. Women's reproductive organs are badly affected and damaged by this condition. Not only that, it affects them emotionally, relationally psychologically and financially. For most women this condition has led to infertility. Personal testimony: "I was a victim from 13 years of age till I menopaused at 52 recently, from day one of my menstrual cycle I suffered severe pelvic pain and it proceeded to other parts of the body. I was diagnosed at 27 years old with stage 4 endometriosis. At that time I was married and trying to conceive, only to find that my entire reproductive system was damaged. Doctors tried, I conceived several times and miscarried all those pregnancies. Then I suffered 2 ectopic pregnancies. All my children died in the womb because someone downplayed and called "normal" the monthly horrible pains I suffered 14 days of every month without fail" Please add your name to this petition to support the call for early and accurate endometriosis diagnosis. References [1] The low down on endometriosis. By Samantha Lee-Jacobs for News24. 01 April 2024 https://www.news24.com/news24/community-newspaper/peoples-post/the-low-down-on-endometriosis-20240401 [2] Endometriosis among African women. By Mecha, E. O., Njagi, J. N., Makunja, R. N., A Omwandho, C. O., K Saunders, P. T., & Horne, A. W. for Reproduction & Fertility, 3(3), C40. https://doi.org/10.1530/RAF-22-0040. July 2022.823 of 1,000 SignaturesCreated by Olga Mkhize

-

Call on Finance Minister and Deputies to increase and expand Sugary Drinks TaxIt is concerning that big businesses have already started publicly pushing for meetings with the new government of national unity. The Consumer Goods Council of South Africa has once again started lobbying against the Sugary Drinks Tax [1]. The sugar industry commissioned studies claiming the HPL was causing job losses. However, researchers from SAMRC/Wits Centre for Health Economics and Decision Science, Priceless SA, found no evidence of job losses due to the HPL [2]. Big business and its associates continue to use their enormous resources to delay, dilute, and delegitimise decisions that are in the public interest. They have proven time and time again that they are bullies and continuously hold the country hostage with threats of job losses and divesting. References [1] Public and private sector cooperation in SA is key to economic growth. https://www.dailymaverick.co.za/article/2024-07-01-public-and-private-sector-cooperation-in-sa-is-key-to-economic-growth [2] https://www.dailymaverick.co.za/article/2024-06-17-sugarcane-growers-stand-by-claims-of-job-losses-linked-to-sugar-tax/3,532 of 4,000 SignaturesCreated by HEALA

-

Bring back the mobile clinic in Ekurhuleni townships, ASAP.South African poor, black women are the face of health inequity [1]. Go to any public healthcare facility around the country's townships and you're likely to find snaking queues characterized by grant earners who are mainly there for their newborns, ailing or child immunization visits, or their own family planning services. This, unfortunately, happens on a daily. I should know because I am one of those women. When my daughter was born on a cold June midday twelve months ago, I was immediately advised to take her to my nearest clinic for her three day's checkup. When I got there, the sister who had examined us then informed me that from then on, I would have to make use of the mobile clinic which operated around the area of Mailula Park in Vosloorus every Mondays and Thursdays. It was a relief to know that I wouldn't have to wake up in the wee hours of the morning, prepare myself and my newborn to brave the snaking queues every time just for her to get immunized. With the mobile clinic which always arrived at 10 O'clock on Thursday mornings, as per my day of preference, I would get there at the same time and got serviced without any hassles. However, with the main polyclinic, it was almost mandatory that parents bringing their children should get there before 8 O'clock or risk getting their heads bitten off by grumpy staff workers who didn't want to have to work overtime, understandably so. The mobile clinic was a welcomed convenience, particularly for those women who lived in the informal settlement of Extension 20, that is far away from poly clinic as that meant that they no longer had to travel, either using money that they don't have for taxi fare, or by walking that long distance with sick children on their backs. However, when I took my baby for her nine month's immunization to the mobile clinic one March Thursday morning, I was shocked to find that I was the only one there with absolutely no queue in sight. A nearby neighbour eventually informed me that the service had been discontinued since January, apparently due to shortage of staff. I found it rather bizarre that that could've been an acceptable reason as it was just in September of 2018 that informal settlements that are not within 3 - 5 km radius from an established clinic around the city were promised to receive healthcare at a step closer through an additional 14 mobile clinics [2]. At my child's recent twelve month's immunization visit, I arrived at poly shortly after 7 O'clock to avoid her picking up germs by staying in the clinic longer than necessary while waiting to get serviced. Needless to say that that was a pointless exercise as not only was I beaten to the front of the queue, but there were scores of mothers who had brought their newborns to their three day's checkup, who arrived after me and had to be placed at the front of the queue as per the clinic's rule. No mother would have any problem with that as we had all been there before and appreciated the Ubuntu. In fact, it had already clocked 11am when one frail looking new mom came in and sat next to me at the reception where I was still waiting to get registered. I told her she didn't have to queue for the three day's checkup, to which she replied and said that she was already denied that privilege as she only arrived then and not before 8 O'clock. I could tell she had not slept a wink and was immediately reminded of my first 72 hours with a colicky infant. I felt it was unacceptable that she was expected to wait about four hours like I just had, just for herself and newborn to get examined. In summary, I asked those who came after me if she could at least be placed in front of us. I left the clinic two hours later, which makes it a total of six hours, with a flu infected child. The World Health Organisation stated that any reform in primary healthcare represents a single great opportunity for the improvement of the lives of people and performance of the healthcare system as a whole [3]. Therefore, the convenience to basic healthcare services is not a privilege, it is a human right. Act now and let us remind the City of Ekurhuleni Municipality of the promise that they made in making basic healthcare services accessible to the poor. Sign this petition below. [1] https://aho.org/news/south-african-poor-black-women-are-the-face-of-health-inequity [2] https://www.sanews.gov.za/south-africa/additional-mobile-clinics-ekurhuleni [3] https://www.gov.za/news/media-statements/new-mobile-clinics-enhance-school-health-programme-and-access-people-informal203 of 300 SignaturesCreated by Nozipho Ntshingila

-

[VICTORY] Calling on Bez valley Clinic to take action against patient discrimination!For years, there have been reports by community members that the staff at the Bez valley clinic have been abusing their powers as healthcare professionals. They have been engaging in unacceptable and criminal behaviour of medical xenophobia. This issue of medical xenophobia is pressing and very problematic. Most undocumented foreign national patients have reported on various platforms that they have been denied their rights to healthcare and are often subjected to xenophobic comments from the staff. As the community we need to make sure that this message is very loud and clear; what is happening at our clinic is against the law. Undocumented individuals have the right to access various healthcare services, these include free access to contraception, HIV/Aids treatment and other basic needs; when it comes to hospital treatment and emergency healthcare these have to be paid for [1]. The criminal behaviour of turning away pregnant undocumented foreign nationals needs to be thoroughly investigated. The laws in South African are very clear and the clinic needs to abide by these laws. Numerous reports have also surfaced on social media platforms where community members have documented how the staff is rude to patients and fail to provide service delivery. The clinic has been documented, repeatedly closing earlier than the scheduled hours; the gates remain open however when you get to the security or the admin section; you will be told that no patient will be assisted after 11 AM. This has also been placing an extreme strain on other clinics around Bez valley, patients end up going to Bedfordview clinic, Hillbrow clinic and Jeppe clinic. On the Facebook group called “The Bez valley Community”; multiple users have submitted posts and videos of evidence where they are being discriminated upon. When these videos are posted they amount massive views and comments from the community members, where different users document their ill experiences at the clinic. In one video, a user called S. Tshuma provides evidence where one of the nurses has instructed the staff not to attend to anyone that comes after 11am. The mother seen in this video is in distress because her child needs emergency assistance, but she had to be turned away because according to the clinic one cannot have an emergency after 11 AM [2]. On the 17th of October 2023, there was another post by L. Tlhageng, where he asked community members to detail their experiences at the clinic. Going through the comment section, it was evident that the majority of the community were expressing the dissatisfaction with the clinic and the main issues was medical xenophobia and the utter disrespect and disregard of their basic healthcare rights. In another video; one of the nurses can be seen shouting abuse at patients that were in the waiting area and telling them that she doesn’t care even if they take the video. What is happening at our beloved Bez valley clinic is against the law. The Constitution states that all people in South Africa, regardless of status or nationality, have the right to have access to health care services, and that ‘no one’ may be refused emergency medical treatment [4]. As a community member you have the power to stop these xenophobic and discriminatory acts! We need to act now! We need to rise, come together and stand up for our rights and make sure that the Bez valley Clinic Manager takes proper urgent decisive action. References: [1] Migrants & Refugees: Health access; www.scalabrini.co.za. [2] S. Tshuma, https://www.facebook.com/reel/645461107742183 [3] https://www.facebook.com/groups/160190411141/search/?q=fikile) [4] Constitution of the Republic of South Africa, 1996. By: Nomzamo Ngcobo165 of 200 SignaturesCreated by Nomzamo Octavia NGCOBO

-

Mayor finish building the Nogqala bridge in NgcoboWe have been promised the bridge for the past 20 years, but not having the bridge is affecting us as residents, children are unable to get to school when it rains they are forced to only return to school in May after the rainy season, which impacts their schooling. High school learners are even forced to rent places closer to the school just so they are able to attend classes [2] We can’t go to the clinic to get treatment, we can't go to town. It's worse when someone passes on, we are forced to carry the coffin for a very long distance because we can't cross that river it's too dangerous. The river has claimed many lives and the delays by the municipality continue to threaten us as the community of Noqgala [3], if you add your name to this petition you can help us get the municipality to hear our cries we are tired of being ignored, 20 years is a long time and we need clear plans and a timeline of when will the bridge be completed. References [1] https://groundup.org.za/article/r97-million-spent-and-three-years-later-still-no-bridge/ [2] https://www.dispatchlive.co.za/news/2023-06-19-r10m-and-two-years-but-villagers-still-without-bridge/#google_vignette [3] https://youtu.be/XoMGTfRhokU68 of 100 SignaturesCreated by Thabisile Miya

-

Help increase child support grant by raising the Health Promotion LevyWe have the power to protect children from hunger if we come together and demand the Minister of Finance to take action. Not only would increasing the Health Promotion Levy raise funds that could help fight child hunger, but it would also help reduce the consumption of sugary drinks, which contribute to Non-Communicable Diseases, which are a major health crisis. We’re not the only ones calling on Treasury to act, over 35 top experts on obesity, diet-related diseases and public health from some of the world’s leading universities have written to Treasury officials to support increasing the current HPL to 20%. They are also very impressed with the results of evaluations done on the current HPL.8,967 of 9,000 SignaturesCreated by HEALA

-

Say no to beer sales in food shops!South Africa rates 5th in the world in the amount of alcohol consumption among drinkers [1]. In addition, alcohol use plays a role in about half of all non-natural deaths [2]. Despite this, the alcohol industry continues to be bold and aggressive in its quest to increase the availability of alcoholic products and make more profits. The Beer Association of South Africa (BASA) in October started calling for beer to be sold at food shops [3]. This is in direct contravention of the National Liquor Act (2003), which prohibits the sale of alcohol other than natural wine at grocery stores and supermarkets. The association must be swiftly stopped in its tracks to protect South Africans from more alcohol harm. According to global trends, the government is supposed to be decreasing access to alcohol by limiting availability in the interest of public health. South Africa already has a disproportionate number of outlets for the population. Those who are supporting the move to allow beers into our food shops are supporting increased harm. If beer is made available in food shops, it will increase easy access and potentially come with discounts and special offers. Some will argue that individuals have the right to choose and take responsibility for their own health, but we know it is not that simple. Individual choice is influenced by the environment in which consumers find themselves. Beers on the shelves of our food shops will increase availability and send a message that beer is just another normal product, like milk, bread, and chocolates. But alcohol is not an ordinary commodity. Currently, South Africans who drink have an unhealthy relationship with alcohol. Statistics show that about one-third of people in South Africa aged 15 and above drink [4]. However, of those who drink, two-thirds drink to the point of intoxication (i.e., binge drinking), causing harm to themselves and others. This practice also diverts government resources away from development priorities like managing alcohol-related harm through policing, trauma admissions, social and disability grants and more. Our Health Minister has already issued a public plea for South Africans to reduce their ‘drinking sprees’ because of the excessive burden alcohol-related cases place on the healthcare system [5]. Already, the Health Ministry will have less budget available to it from next year because of budget cuts – it cannot afford to waste even more of its limited budget on a further increase in alcohol harm-related cases. COVID showed us that less alcohol availability means less trauma and fewer hospital admissions. It means a safer society for our people. This call by the liquor industry is irresponsible, showing a disregard for the health and welfare of the public and for the government purse. We call on everyone in Mzansi to support our call for #NoBeersInSAFoodshops. By signing this petition, you are joining us in saying we do not need beer in our food shops, there are enough places to buy beer. #NoBeerSalesInSAFoodshops #HandsOffLiquorAct #AlcoholSaferSA References: [1] https://www.who.int/publications-detail-redirect/9789241565639 [2] Parry South Africa: alcohol today. Addiction. 2005;100(4):426–9. [3] https://www.iol.co.za/weekend-argus/news/beer-association-wants-beer-to-be-sold-in-supermarkets-347d921a-068b-4697-85b8-00b521a3b1fc#:~:text=Cape%20Town%20%2D%20With%20more%20than,at%20grocery%20stores%20and%20supermarkets. [4] https://substanceabusepolicy.biomedcentral.com/articles/10.1186/s13011-018-0182-1 [5] https://www.news24.com/news24/southafrica/news/drinking-sprees-bird-flu-and-cost-cutting-health-minister-joe-phaahla-worried-over-public-healthcare-20231012.153 of 200 SignaturesCreated by SAAPA

.png)

%20(1).png)

.png)

.jpg)

.png)

.jpg)

.png)

.jpg)