- Featured

- Clean air

- Climate justice

- Consumer Rights

- Corporate Accountability

- Data access

- Early Childhood Development

- Economic fairness

- Education

- Electoral fairness

- Environmental justice

- Food justice

- Gender based violence

- Grants/social assistance

- Health

- Housing and infrastructure

- Industry interference

- Land Justice

- LGBTQIA+ rights

- Media/ information access

- Public transport

- Racism

- Reparations

- Safety

- Sanitation

- Service Delivery

- Sexual and Reproductive Rights

- Social justice

- Unemployment

- Womxn's rights/ gender equality

- Workers' rights

- More

-

Make SA schools safe spaces for children and learningAs learners return to class, RISE Mzansi calls on President Cyril Ramaphosa to prioritise, among other issues, School Safety during this year’s State of Nation Address (SONA). In 2015, the National Schools Safety Framework was launched to guide the Department of Basic Education, schools, districts and provinces to ensure a common understanding of the extent of school violence and provide evidence on how to mitigate it. The plan to work with SAPS and the Department of Social Development (DSD) to protect learners and combat social ills, has had little effect as South Africans see a rise in violence at schools and teenage pregnancies which saw an increase from 90 000 in 2022 to 150 000 in 2023 [1]. From January to September 2023, there were 27 murders, 59 attempted murders, 707 assaults and shockingly 229 rapes [2] on at educational facilities, contributing to the rise in pregnancies and dropout rate for adolescent girls. If you sign this petition you are helping us get a step closer to ensuring that schools are a safe learning environment for parents and teachers. References [1] SAPS, 2023. Crime statistics. https://www.saps.gov.za/services/crimestats.php [2] SABC News, 2023. Adolescent/ Teenage Pregancy in South Africa. https://www.sabcnews.com/sabcnews/infographic-adolescent-teenage-pregnancy-crisis-in-south-africa/#:~:text=Current%20statistics%20on%20adolescent%2Fteenage,the%202022%2F2023%20financial%20year.10 of 100 SignaturesCreated by Gaopalelwe Phalaetsile

-

Petition for Minister Creecy's Promised Increase in Traditional Line Fish Allocation for SSFWith Small-scale fishing (SSF) rights now granted across all provinces in South Africa, there arises a significant concern among small-scale fishing cooperatives regarding the economic viability of the species allocated in their basket for sustainable livelihoods. On 4 March 2024, Department of Forestry, Fisheries and the Environment (DFFE) announced the traditional linefish total allowance effort (TAE) for the 2024/2025 fishing season. In a media statement on 6 March 2024, Masifundise and Coastal Links expressed deep dissatisfaction with the DFFE’s announcement regarding the Traditional Linefish TAE. The allocated TAE for the small-scale fishing sector is inadequate and insufficient efforts have been made to ensure SSF communities have a viable basket of species. The implementation of the SSF Policy in South Africa lacks assurance for improving conditions for small-scale fishers, not due to the Policy itself but due to DFFE’s consistent prioritisation of commercial and recreational fisheries. Traditional line fish is the cornerstone of a viable basket which can ensure food security and local economic development. But food security is not the only aspect to be considered, TLF species like snoek and yellowtail are an important cultural and traditional foods for the coastal communities, as well as for the culture of small-scale fishers. It is clear that the concerns around the TLF announcement be addressed immediately. Masifundise launched a petition urging Minister Barbara Creecy and DFFE to fulfill their commitment of allocating 50% of the Traditional line fish TAE to SSF.275 of 300 SignaturesCreated by Masifundise Development Trust

-

Say no to beer sales in food shops!South Africa rates 5th in the world in the amount of alcohol consumption among drinkers [1]. In addition, alcohol use plays a role in about half of all non-natural deaths [2]. Despite this, the alcohol industry continues to be bold and aggressive in its quest to increase the availability of alcoholic products and make more profits. The Beer Association of South Africa (BASA) in October started calling for beer to be sold at food shops [3]. This is in direct contravention of the National Liquor Act (2003), which prohibits the sale of alcohol other than natural wine at grocery stores and supermarkets. The association must be swiftly stopped in its tracks to protect South Africans from more alcohol harm. According to global trends, the government is supposed to be decreasing access to alcohol by limiting availability in the interest of public health. South Africa already has a disproportionate number of outlets for the population. Those who are supporting the move to allow beers into our food shops are supporting increased harm. If beer is made available in food shops, it will increase easy access and potentially come with discounts and special offers. Some will argue that individuals have the right to choose and take responsibility for their own health, but we know it is not that simple. Individual choice is influenced by the environment in which consumers find themselves. Beers on the shelves of our food shops will increase availability and send a message that beer is just another normal product, like milk, bread, and chocolates. But alcohol is not an ordinary commodity. Currently, South Africans who drink have an unhealthy relationship with alcohol. Statistics show that about one-third of people in South Africa aged 15 and above drink [4]. However, of those who drink, two-thirds drink to the point of intoxication (i.e., binge drinking), causing harm to themselves and others. This practice also diverts government resources away from development priorities like managing alcohol-related harm through policing, trauma admissions, social and disability grants and more. Our Health Minister has already issued a public plea for South Africans to reduce their ‘drinking sprees’ because of the excessive burden alcohol-related cases place on the healthcare system [5]. Already, the Health Ministry will have less budget available to it from next year because of budget cuts – it cannot afford to waste even more of its limited budget on a further increase in alcohol harm-related cases. COVID showed us that less alcohol availability means less trauma and fewer hospital admissions. It means a safer society for our people. This call by the liquor industry is irresponsible, showing a disregard for the health and welfare of the public and for the government purse. We call on everyone in Mzansi to support our call for #NoBeersInSAFoodshops. By signing this petition, you are joining us in saying we do not need beer in our food shops, there are enough places to buy beer. #NoBeerSalesInSAFoodshops #HandsOffLiquorAct #AlcoholSaferSA References: [1] https://www.who.int/publications-detail-redirect/9789241565639 [2] Parry South Africa: alcohol today. Addiction. 2005;100(4):426–9. [3] https://www.iol.co.za/weekend-argus/news/beer-association-wants-beer-to-be-sold-in-supermarkets-347d921a-068b-4697-85b8-00b521a3b1fc#:~:text=Cape%20Town%20%2D%20With%20more%20than,at%20grocery%20stores%20and%20supermarkets. [4] https://substanceabusepolicy.biomedcentral.com/articles/10.1186/s13011-018-0182-1 [5] https://www.news24.com/news24/southafrica/news/drinking-sprees-bird-flu-and-cost-cutting-health-minister-joe-phaahla-worried-over-public-healthcare-20231012.153 of 200 SignaturesCreated by SAAPA

-

Tell Treasury transparency is not optionalTreasury is refusing to answer a very simple question. Did big sugar businesses influence their decision to reverse the sugary drinks tax increase? Last year, campaign supporters flooded Treasury with messages calling for transparency, and HEALA submitted a Public Access to Information Act (PAIA) application. Treasury’s refusal to account to the public is a red flag, especially because Finance Minister Godongwana gave big sugar businesses what they wanted: a two-year moratorium on increasing the sugary drinks tax. But this isn’t over. Finance Minister Godongwana is delivering his Mid-Term Budget Policy Statement (MTBPS) next week, and he is under pressure to raise funds. Treasury has suggested increasing VAT by 2%, which would fuel the cost of living crises. This is our opportunity to push for increasing the sugary drinks tax (HPL) instead. Can you take a moment to send a message to Treasury?90 of 100 SignaturesCreated by HEALA

-

VICTORY: Protect the SABCs independence #HandsOffSABCIf the President and other politicians respect our democracy, constitution, and independence of the public broadcaster, why support this Bill? We are currently in the lead-up to elections, and media outlets will be sharing important election updates from various political parties with us. This highlights the importance of the SABC as a national broadcaster. With all these 2024 election activities set to happen, the new SABC Bill that is currently before the PPCC is being rushed to be passed into law, raising concerns. Why the rush? If the Bill is passed in its current state, the Minister will have powers to influence the news and content the SABC covers, similar to the Hlaudi era. During the Hlaudi era, we saw how the SABC news was captured. The firing of journalists, the meddling of SABC operations, and widespread censorship all affected the Public Broadcaster, causing us to lose trust in it. We, as the SOS Coalition, were at the forefront of fighting to protect the independence and integrity of the SABC then, as we are now. To opt-in to receiving more campaign information from SOS, click on this link: https://forms.gle/s775kMfwKj7epE5J9 The Bill should help with the ongoing challenges at the SABC, grant the SABC greater independence from political interference, bolster its ability to hold the government accountable and introduce a sustainable funding model. However, it has clauses which do the opposite. Given this and the rush to have the Bill passed, concerns regarding the exploitation of the public broadcaster to favour certain political parties over others in the lead-up to the elections are growing. This is why we need your help to protect the SABC from politicians with ulterior motives. We are calling for #HandsOffSABC. The public broadcaster needs to remain independent and impartial in its election’s coverage. The Bill threatens this independence and is, therefore, a threat to our democracy. To opt-in to receiving more campaign information from SOS, click on this link: https://forms.gle/s775kMfwKj7epE5J9895 of 1,000 SignaturesCreated by SOS Support Public Broadcasting Coalition

-

Urge the Minister of Finance & National Treasury to continue funding short-term work opportunitiesWe know that one of the biggest challenges for young people trying to get into the labour market is the lack of work experience, with the National Treasury estimating that only 2 in 10 young people are likely to find a job. By providing young people with valuable opportunities to grow competencies and learn work skills, the Basic Education Employment Initiative, the Social Employment Fund and other public employment programmes support the private sector by preparing a generation of young people to transition into the labour market, effectively derisking youth unemployment. There is no single silver bullet, but short-term opportunities that are part of the Stimulus are crucial in addressing that gap, and leading young people into sectors that critically need support or those that are rife with potential for growth. These programmes also drive money into local economies while providing skills - this is a key strategy to improve South Africa’s economic growth, offering our future workforce a springboard for income generation. Incomes, paid at the National Minimum Wage, have boosted purchasing power for entire households; young people reported spending their wage mostly on food, in small enterprise and the informal sector as well as in major retailers, or using it as seed capital for entrepreneurship ventures. Our economy depends on it now.25,229 of 30,000 SignaturesCreated by Youth Capital

-

Tell CUT Management to allow all eligible students to graduate.Over 500 students of the Central University of Technology who are due for graduation in the 2023 Spring Graduation Ceremony won’t be graduating. On the 10th of August 2023, the institution released a graduation list that has only 29 students, leaving over 500 other students behind. The university claims that these students were excluded from the list due to them not submitting certified copies of their identity documents and matric certificates. The university usually publishes a preliminary list that informs with outstanding documents to upload them, well this time it wasn’t done. The very same institution that was quiet about the graduation until 10 August, is not willing to update the list or even guide its students on what to do. It is surprising that documents like IDs and Matric certificates are among the outstanding documents at final year, whereas they are a requirement when applying to the institution. It matters not to the institution that the excluded students, who are the majority by the way; worked hard to get to this moment. These are students whose families are eagerly waiting for their qualifications to better their livelihoods. This act by the Central University of Technology doesn’t favour a poor black young person whose only hope at a better life is their qualification. On the same day, the graduation date was published. Majority of the institution’s students are from low-income communities and studied using NSFAS funding, the 1st of September 2023 is a ridiculous date. How are black students from poor families expected to prepare for graduations within 21 days? Instead of celebrating this well deserved moment, students that are eligible for graduation are in distress due to the institution’s incompetence and financial constraints that come with the graduation ceremony. A number of students have taken to the university’s student-created Facebook group to voice their dissatisfaction about this. Some say they won’t be able to attend the ceremony because they won’t be able to afford the graduation regalia at such a short notice, most want to know what is going to happen with them because they are not on the graduation list, students of the Welkom campus are complaining about the distance and costs involved in getting to the venue. Who is this graduation actually for if it is inconvenient for graduating students to attend? As a student of the institution affected by this, I’m convinced that the university does not care about its students and alumni. This is a call to all CUT registered students to disrupt this ceremony and the students who are on the list to boycott this graduation. No student should be left behind. If they can do it to these students, they can do it to you too. Sign this petition and give a black student from a low-income community a chance to attend their graduation ceremony. References [1] https://www.cut.ac.za/events/cut-spring-graduation-ceremony-2023 [2] https://www.cut.ac.za/graduate-list [3] https://southafricaportal.com/cut-graduation-ceremony/ [4] https://www.facebook.com/groups/28278289488/631 of 800 SignaturesCreated by Minothando Hlanganyana

-

Ministers of police and justice must automatically clear criminal records on Police record systemsHaving a criminal record can make it impossible to secure employment, a visa, or exercise other basic rights. It has serious effects on our personal, family and working lives. The law has changed, but many people do not know it is possible to get their records cleared. Some are not even aware that they have a criminal record – they find out when they are looking forward to a new job, a promotion, or travel overseas, and their hopes are dashed. Expungement (removal or erasure) of criminal records is allowed for certain offences after a fixed period of time. The process is free, except for the cost of a police clearance certificate (PCR) Police Clearance Report at a cost of R75. However, people needing help often find themselves paying high fees. We should all work to ensure those who have slipped through the cracks and offended the state should not be enslaved by the state for their most productive lives. The process of the state must be fair, just and led by research. We cannot build a peaceful, fully loving and productive country in an adversarial manner where punishment never ends for the poor, vulnerable and lesser prepared for life's challenges. For more information, click this link: https://clearmeapp.co.za/ [1] Expungement of a criminal record, SAPS: https://www.saps.gov.za/faqdetail.php?fid=57#:~:text=Procedure%20to%20follow%20to%20obtain,and%20dates%20of%20the%20offence862 of 1,000 SignaturesCreated by Clear Me

-

Campaign Victory: No more Admin penalties for struggling ECD centres in Cape TownThe City of Cape Town has released a Draft Exemption from the Administrative Penalty for Certain ECD Centres in the City – and there is now a call for public comment. Background: To provide context, an ECD centre needing to comply with municipal by-laws and become registered as a partial care facility is required to obtain land use and building plan approvals. Before an application for these approvals can be considered, if an ECD centre located in the City of Cape Town operates without the necessary land use in place or approved building plan, the centre must first apply for and pay an administrative penalty. The Penalty: This penalty, which in our experience has ranged from R500 to R12,000, is a disincentive for ECD centres to become compliant and often penalises the centres attempting to operate legally as opposed to those who do not start the land use application process and so might never have to pay this penalty. The threat of this penalty can scare principals off. On the other hand, there are those ECD centres that do not know about this penalty and it comes as an unexpected expense to ECD centres trying to register and operate legally. Unfortunately, many ECD centres in Cape Town (and across South Africa) are not financially able to pay these penalty fees. The City of Cape Town: The Centre for Early Childhood Development (CECD) has been engaging with the City of Cape Town and the Mayor’s office around local barriers to ECD centre registration, including this requirement to pay an administrative penalty. The City of Cape Town is now proposing that ECD centres in certain areas (as per the City’s suggested map of areas) operating without the necessary land use in place or having built a structure without approved building plans, will be exempt from having to pay an administrative penalty before seeking these approvals – this is a win for the ECD community! The Submission: We (CECD) support the proposed exemption for ECD centres, however, we strongly suggest changes be made to the legal wording of the exemption to (a) ensure that all ECD centres in the suggested areas are automatically exempt from paying administrative penalties for both illegal land use and building work, and (b) remove potential conflict of interpretation/application of this exemption that could nonetheless require these centres to pay administrative penalties. Moreover, there are many poor areas which we think should be included in the list of exempted areas for ECD centres, that are not included on the proposed map. How you can support this effort: CECD has worked with lawyers and researchers to draft comments on this proposed exemption. You can support CECD’s comments, by submitting the email on this page. If you submit this email, please add in your own personal comments on how being exempt from admin penalties could affect ECD centres/what it means to you. You can write a line or two after the words, “Personal comments”. If you would like to submit your own comments, please consider including CECD’s changes that we strongly suggest should be considered. You can submit your own comments online, via this link: Feedback (capetown.gov.za) or you can send your comments via email to [email protected]. Important Links: * The document with the proposed exemptions can be found here: https://bit.ly/42C2qZj * The map illustrating the areas that the City is proposing should be exempt from an administrative penalty can be found here: https://bit.ly/41mzSlw * The City of Cape Town’s webpage on this matter, with some additional information is here: https://bit.ly/3plBLBQ The Impact: If the current map of exempted areas proposed is implemented, it would impact a total of 1,085 centres; 38,924 children and 4,708 staff members. However, there are numerous more centres in poor communities that are not included in this proposed map. As such CECD has suggested a strategy to add additional suburbs in the City of Cape Town to the current map of exempted areas. We encourage you to please use this opportunity and give your comments to the City of Cape Town. The number and content of the comments made on this exemption make a difference. This is a chance for us to have our voices heard. Let’s influence the process that affects us and change the law in a way that the rules and regulations support the ECD community.321 of 400 SignaturesCreated by Michaela Ashley-Cooper

-

We want a skills development center at NgwelezaneConverting IThala Building into a skills development institution will not only fix the issue of the abandoned building but it will empower the youth with various skills that will equip them for entrepreneurship or job market. Revamping and repurposing of the building will be executed by a team of students as part of their Work Integrated Learning and Leanership programme which will be mainly funded by various SETA’s, thus cutting down the labour costs significantly.249 of 300 SignaturesCreated by Mpendulo Mbulawa

-

Demand warning labels on all unhealthy foodMany of us don't realise that some food products we buy threaten our health [1]. Big food businesses have used adverts and health claims to influence what we eat for years. Massive profits have been made selling us products high in sugar, salt, fat and added sweetener. We are seeing more and more people in our communities suffering from diseases like type-2 diabetes and high blood pressure that can lead to stroke or heart disease [2]. Our children are targeted by adverts and marketing strategies that can influence what they eat for years. But we have an opportunity to help change this. The good news is that government is listening to public health experts and considering regulations that would limit advertising and force businesses to put warning labels on their unhealthy products [3] so we know what is in our food. But some big businesses will do anything to protect their profits even if it hurts our health. Cigarette companies tried to stop government warning labels on their products [4], and already some big food businesses have been finding ways to lobby the health department behind closed doors [5]. We only have until the end of the 21st of September 2023 to send in enough public comments to show the health department that we support warning labels on all unhealthy food and regulating advertising aimed at children and misleading health claims. The evidence is on our side [6], so if enough of us come together to send public comments to support stronger regulations with no loopholes, our leaders may have no choice but to listen. [1] https://sajs.co.za/article/view/3761 [2] https://www.thelancet.com/journals/langlo/article/PIIS2214-109X(16)30113-9/fulltext [3] https://www.gov.za/sites/default/files/gcis_document/202304/48460rg11575gon3337.pd [4] http://legacy.library.ucsf.edu/tid/ldc73a99/pdf [5] https://www.dailymaverick.co.za/article/2022-05-30-heres-why-you-should-care-about-the-food-industry-lobbying-the-health-department-behind-closed-doors/ [6] https://www.sciencedirect.com/science/article/pii/S0195666322003749 https://www.ncbi.nlm.nih.gov/pmc/articles/PMC9388905/ https://journals.plos.org/plosone/article?id=10.1371/journal.pone.02576266,939 of 7,000 SignaturesCreated by HEALA

-

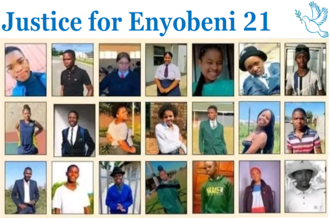

We demand accountability for the systemic failures that led to the Enyobeni tragedyTo civil society organisations and individuals across the country, The Enyobeni Tavern tragedy doesn’t just affect the families, friends and communities of the 21 young people who died in the early hours of 26 June 2022. It affects all of us because it could have happened anywhere in the country – in alcohol outlets in cities, towns and villages across all provinces, in rich or poor areas, in suburbs, townships or informal settlements. It’s easy to point a finger at the adults responsible for running the tavern. Some people even blame the parents, the children themselves. But where does the real responsibility lie? We elect local, provincial and national governments to serve us, to ensure our health, safety and wellbeing, to protect us from harm. We expect government to put in place laws that set guidelines for what can and can’t be done and to ensure that those laws are enforced. We expect government to identify challenges in society and to address them. We expect government to be responsive, to listen to us, the people who voted them into service. Please sign this petition and share it with others. We need to speak with a loud voice to call on the President to ensure there is a proper inquiry into the Enyobeni Tavern tragedy and that effective steps are taken to make sure it never happens again. The lives of the Enyobeni 21 can never be brought back, but we can make sure that their deaths are not in vain, that they can lead to the creation of an alcohol-safer South Africa going forward. Sign the petition now and share with everyone you know! Issued by the Southern African Alcohol Policy Alliance in SA (SAAPA SA), supported by the Scenery Park 21 Families Support Organisation and the South African Council of Churches (SACC), Eastern Cape1,125 of 2,000 SignaturesCreated by Southern African Alcohol Policy Alliance in SA (SAAPA SA)

.png)

.png)