- Featured

- Clean air

- Climate justice

- Consumer Rights

- Corporate Accountability

- Data access

- Early Childhood Development

- Economic fairness

- Education

- Electoral fairness

- Environmental justice

- Food justice

- Gender based violence

- Grants/social assistance

- Health

- Housing and infrastructure

- Industry interference

- Land Justice

- LGBTQIA+ rights

- Media/ information access

- Public transport

- Racism

- Reparations

- Safety

- Sanitation

- Service Delivery

- Sexual and Reproductive Rights

- Social justice

- Unemployment

- Womxn's rights/ gender equality

- Workers' rights

- More

-

Gender Wage Gap: Banyana Banyana must get equal pay!South African women earn 27% less than men [2]. Our country already faces so many gendered social and economical issues and the gender pay gap also contributes to these issues. Our national women’s soccer team Banyana Banyana is just one example of women who work hard, yet they still remain underpaid and underfunded compared to Bafana Bafana (national men’s soccer team). If the argument has been that men work harder than women and “deserve” a higher pay, then without a doubt our women’s team have proven themselves to have worked harder than the men, but the willingness to increase their salaries still remains low. Earning an equal salary should not be about one’s gender, it should be about the fact that people do the same work in the same industry, and therefore should be paid the same. The time is now - SAFA must take action and pay the women what they deserve. References: [1] Jordaan calls for help to boost Banyana salaries amid outcry, Matshelane Mamabolo for IOL, 30 November 2018 [2] Do South African women earn 27% less than men?, Gopolang Makau for Africa Check, 27 September 2017700 of 800 SignaturesCreated by Yolanda Dyantyi

-

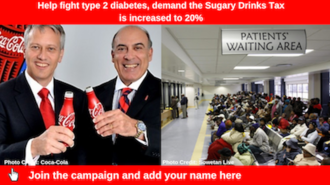

Help fight type 2 diabetes, demand the Sugary Drinks Tax is increased to 20%Companies like Coca-Cola have been allowed to sell a product that drives type 2 diabetes [1] and they have specifically targeted poor communities who have the least access to quality health services [2]. We all know that many of our schools and spaza shops are covered with Coca-Cola adverts, and for decades many of us didn’t know the truth about sugar in cold drinks, and now many people have family members who are too sick to work. While Coca-Cola makes millions, the queues at our clinics grow longer. In 2017 there were over 100,000 new diabetes cases in the public sector alone [3]. There’s hope though. Thanks to public pressure a Sugary Drinks Tax was introduced in 2018, but our work isn’t done yet. Because of companies like Coca-Cola, the tax was watered down to almost half of what Wits academics have said it needs to be: 20% [4]. 89% of private companies were found not to be paying taxes properly in 2017 [5], yet every day we have to bear the high costs of the VAT hike, and yet there isn’t enough for government funding for health and education. Because of private companies not paying taxes properly, Treasury has cut R350 million from our health budget since the February 2019 budget and now [6] [7]. We need much more money for our health budget, not less. Between now and February 2020, Treasury may make big decisions about our budget and taxes. We know that wealthy companies and individuals will be fighting against taxes on themselves and their products, but if enough of us come together, we could send a clear message to Treasury that we want a strong sugary drinks tax of 20% announced in February 2020 budget speech. We stopped Coca-Cola’s attempts to scrap the Sugary Drinks Tax last year, and now more than ever, we need a strong taxes on products that can be deadly to our health, products like sugary drinks, cigarettes and alcohol. A 20% sugary drinks tax could fill the R350 million hole in our health budget, and prevent more people from consuming sugary drinks which drive diseases like type 2 diabetes, heart disease, liver and kidney damage, and some cancers. [1] Decreasing the Burden of Type 2 Diabetes in South Africa: The Impact of Taxing Sugar-Sweetened Beverages Mercy Manyema, J. Lennert Veerman, Lumbwe Chola, Aviva Tugendhaft, Demetre Labadarios, Karen Hofman Published: November 17, 2015 [2] Big business - and people - grow fat on sweetened drinks. Lynley Donnelly for Mail & Guardian 1 June 2016 [3] Junk food, junk status cause skyrocketing medical costs. Amy Green for Health-e News 24 April 2017 [4] Sugar tax could save South Africa billions in diabetes costs. Thabo Molelekwa 29 April 2016 Health24 [5] Corporates ‘not tax compliant’. Baldwin Ndaba for The Mercury, 22 Aug 2018. [6] http://www.treasury.gov.za/documents/national%20budget/2018/review/FullBR.pdf [7] http://www.treasury.gov.za/documents/mtbps/2018/mtbps/FullMTBPS.pdf11,439 of 15,000 SignaturesCreated by Heala

-

Tell Pres. Ramaphosa to give pensioners R2500 and a 13th cheque in DecemberThe majority of pensioners in South Africa when they worked did not earn enough to support their families and save for their retirement. When they reached retirement age, their only option was to go onto the state old-age pension. The massive levels of unemployment together with the VAT hike, and massive hikes in food, transport and electricity has put enormous pressure on their pensions. Pensions, like wages, bring income into the home. The old-age grant is R1 700(in 2018) a month which supports entire families making it a poverty-level grant. December and January are very long months for the 3.5 millions pensioners on this grant. They have to stretch R1 700 (in 2018) to pay for school uniforms, school fees, stationery and lunches for their grandchildren starting school in January. Even though pensioners try and put money aside by sacrificing their own needs during the year because of the increased financial pressure and deepening unemployment crisis; pensioners will have to go into deeper levels of debt to support their families. Pensioners are very worried that the extent of the debt will push them into ever deeper levels of poverty. Pensioners feel that a 13th cheque in December will help them absorb some of the pressures of these extra expenses over the December and January period and allow families to be in a better position come January and the New School year. Already Pensioners travelled to Parliament and spoke to MPs about their demands [1] [2]. With the State of the Nation Address tonight, Government is deciding how they will allocate the budget. If enough of us come together we can support the Pensioners' call for economic justice and dignity and ensure the 13th cheque is announced at SONA and included in the 2019 budget (though the President's failure to mention the 13th cheque in the SONA and Minister Mboweni’s failure to include the 13th cheque in the 2019 budget were setbacks, our Gogo’s have not backed down from their demand for a 13th cheque. We are continuing with the fight for a 13th cheque). [1] Gogos Call for better pension, Nokuthula khanyile for News24, 31 October 2018. [2] https://www.power987.co.za/news/mtbps-gogos-wants-christmas-bonus-from-tito-mboweni/59,109 of 75,000 SignaturesCreated by Pietermaritzburg Pensioners Forum

-

Call on ANC to support reversing the VAT hike in 2019Earlier in the year amandla.mobi ran a campaign against the VAT hike and submitted a petition with 55,000 signatures to all 400 members of parliament (MP). Not one MP responded. Even the biggest political parties have said they are against the VAT hike [1], and many have said the VAT hike would hit the poor the hardest, yet it was passed on their watch. But in the next few weeks, starting from Wednesday 7 November, Parliament will be discussing our budget and taxes. It doesn’t matter which political party you voted for, or if you voted, MPs are our elected representatives and work for us. We have an opportunity now to remind them they work for us and can’t ignore the voice of the people. If enough of us come together and flood the inboxes of the key leaders of the 6 largest political parties, almost every MP will hear our voices and the conversation could be shifted towards reversing the VAT hike in 2019, and forcing wealthy companies and individuals to pay their fair share. We welcome Treasury including sanitary pads, white bread and flour in the list of tax-free items but the poor are still in economic crisis and the VAT hike lays the burden of fixing the economy on the shoulders of the poor. The gap between the rich and poor in Mzansi is one of the largest in the world. It is unjust that Treasury keeps proposing solutions to the economy by increasing the tax burden on the majority, especially poor Black women when 89% of companies in SA are not tax compliant in 2018 [2] and R965 billion leaves the continent in illicit financial flows every year. [3] Mzansi is dominated by greedy companies. We the people essentially subsidize corporates. Government and Treasury should tax the mega-rich instead. amandla.mobi is an independent, non-partisan community organisation that fights for economic and social justice. We are targeting all 6 major political parties’ key leaders. You can call on the other 5 to support reversing the VAT hike in 2019 and call for treasury to tax the mega-rich instead here: DA: https://awethu.amandla.mobi/petitions/call-on-the-da-to-support-reversing-the-vat-hike-in-2019 EFF: https://awethu.amandla.mobi/petitions/call-on-the-eff-to-support-reversing-the-vat-hike-in-2019 IFP: https://awethu.amandla.mobi/petitions/call-on-the-ifp-to-support-reversing-the-vat-hike-in-2019-1 NFP: https://awethu.amandla.mobi/petitions/call-on-the-nfp-to-support-reversing-the-vat-hike-in-2019 UDM: https://awethu.amandla.mobi/petitions/call-on-the-udm-to-support-reversing-the-vat-hike-in-2019 We are also flooding the inboxes of the remaining 377 members of parliament with a clear message, support reversing the VAT hike in 2019 and call for treasury to tax the mega-rich instead. If you have time, contact us at [email protected] and we will get back to you with more information on how you can take action. Between the tens of thousands who are part of this campaign, if each of us send messages they will have no choice but to respond to our demands. [1] OUTA, ANC Gauteng and civil society groups march to Union Buildings, Canny Maphanga and Alex Mitchley News24 October 2018 (ANC) Yunus Carrim: ANC didn’t want VAT hike, Masego Rahlaga EWN February 2018 (ANC) DA plans march against VAT increase, Brenda Sinenhlanhla Masilela ANA February 2018 (DA) EFF'S Malema Calls On SA To Unite Against VAT Increase, Koketšo Motau EWN March 2018 (EFF) [2] Corporates not ‘tax compliant’. Baldwin Ndaba and African News Agency for The Mercury 22 Aug 2018 [3] Parliament: Illicit financial flows and the history of disappointment. Greg Nicolson for the Daily Maverick. August 2017155 of 200 SignaturesCreated by Khaliel Moses

-

Gold miners are dying of silicosis and TB while waiting for compensation, demand action!Government institutions tasked with compensating sick miners have become dysfunctional with backlogs of 200 000+ unpaid certified claims and an even larger number of unprocessed claims. Stringent requirements and processing centralised in Johannesburg makes it very difficult for sick and repatriated miners to access compensation. Many are unaware of their rights to compensation and thousands have already died without being compensated. Without serious reform of the compensation system, and a concrete plan of action from the TSHIAMISO TRUST, most of the 500 000 miners will die without receiving anything, unless we make this our business and do something. THE COMPENSATION SYSTEM IS BROKEN and if the R5 billion is not paid out within 12 years, it will remain with the mining companies.1,383 of 2,000 SignaturesCreated by Breathe Films

-

Stop another VAT hike, tell Pres Ramaphosa to commitIn the last few days a conservative economist has been suggesting to the media that there could be another VAT hike in 2019 [1]. It’s suspicious that some economists, with connections to the private sector, suggest a VAT hike rather than a corporate income tax hike. This could be the private sector's agenda or national government testing how angry people would be with another VAT hike. Right now, with a new Finance Minister and the mid-term budget announcement just one week away, we have an opportunity to immediately push back against the idea of a VAT hike. If enough of us come together, we can flood the inbox of the Presidency with a clear message: we the people will not pay the bill. If we act quickly President Ramaphosa may have no choice but to commit to not increasing the VAT in 2019. The gap between the rich and poor in Mzansi is one of the largest in the world. It is unjust that Treasury keeps proposing solutions to the ongoing economic crisis by increase the tax burden on the majority, especially poor Black women. 89% of companies in SA are not tax compliant [2] and R965 billion leaves the continent in illicit financial flows every year. [3] Mzansi is dominated by greedy multinational companies. We the people essentially subsidize corporates. Tell government and Treasury to tax the mega-rich instead. [1] SA could face another VAT increase, say experts. Citizen Reporter for The Citizen October 2018 [2] Corporates not ‘tax compliant’. Baldwin Ndaba and African News Agency for The Mercury 22 Aug 2018 [3] Parliament: Illicit financial flows and the history of disappointment. Greg Nicolson for the Daily Maverick. August 20171,609 of 2,000 SignaturesCreated by amandla mobi member

-

Stop Heineken and others using labour brokers to bypass labour lawsHeineken, Kellogg’s, Ferrero and PepsiCo (Simba Chips) are massively rich multinational companies based in the Netherlands, Italy and the USA respectively. They have clearly bought into the neoliberal idea that the corporations of the 1 percent of the wealthiest people in the world are free to break the law when it comes to the rights of labour broker workers. They have all resisted the rights that parliament enacted for labour broker workers in 2015 with all the power their wealth gives them. They have victimised and dismissed worker leaders who organised to claim these rights. When workers persisted and forced them to concede these rights, they have responded by taking revenge by retrenching hundreds of these workers. South Africa’s precarious workers cannot afford the behaviour of these giant corporations. We call on you to call them to order. When Shoprite made themselves guilty of similar behaviour in Zambia in 2013, the Zambian government called them to order. The Zambian government told Shoprite to respect workers’ rights or lose their trading licence. We call on you to follow the example of the Zambian government. TELL THESE COMPANIES OF SHAME TO RECOGNISE THEIR PERMANENT EMPLOYEES AND TO GIVE THEM EQUAL TREATMENT TELL THESE COMPANIES OF SHAME TO REINSTATE ALL DISMISSED AND RETRENCHED WORKERS TELL THESE COMPANIES OF SHAME YOU WILL CANCEL THEIR TRADING LICENCES IF THEY CONTINUE TO VIOLATE THE RIGHTS OF LABOUR BROKER WORKERS [i] 80% of labour broker workers should be deemed permanent – report, by Dewald van Rensburg for fin24.com, 16 August 2018314 of 400 SignaturesCreated by Clio Koopman

-

Increasing access to safe abortions in South AfricaThe right to sexual and reproductive health (SRH) is an essential component of the right to life, the right to health, the right to education, and the right to equality and non-discrimination. Many women, young women, adolescent girls, and gender non-conforming people in South Africa are vulnerable to ill-health due to several economic and social barriers that prevent them from accessing timely and life-saving SRH services, including safe abortion and contraception. Better access to these services can prevent unsupported pregnancies and reduce unsafe abortions. When a woman is denied unencumbered access to these services, her agency and the right to make decisions about her body are limited. More than two decades have passed since the progressive Choice on Termination of Pregnancy Act (CTOPA), 1996, liberalised abortion in South Africa. However, women in South Africa continue to face barriers in accessing safe abortion services. This is due to severe stigma, refusal by healthcare providers to provide services due to their religious or moral beliefs, lack of information on the legally safeguarded rights under the CTOPA, and poor infrastructure and limited availability of safe abortion services. Due to these barriers, women and adolescent girls often resort to illegal and unsafe abortion services, which put their health and lives at risk. Unchecked advertising of ‘quick and pain free abortions’ by illegal providers perpetuates the stigma and misinformation about abortion among the population. According to a 2009 study, two illegal abortion procedures took place in South Africa for every safe legal procedure. Globally, unsafe abortion is one of the top five causes of maternal mortality, along with post-partum haemorrhage, sepsis, complications from delivery, and hypertensive disorder. In our country, many women die every year, or sustain injuries and disabilities due to unsafe abortions. For example, the 2014 Saving Mothers report, covering the period from 2011 to 2013, reveals that pregnancy-related sepsis accounted for 9.5% of maternal deaths during the said period.332 of 400 SignaturesCreated by My Body My Choice Campaign

-

Cigarette companies make billions while our lines get longer. Increase the tobacco taxEach year South Africa spends more than R59 billion [1] to address tobacco related illnesses like lung cancer, emphysema, asthma and bronchitis. At the same time the country only collects between R11 billion and R13 billion from tobacco taxes. Last year South Africa’s largest tobacco company British American Tobacco alone took a profit of R2.3billion, after tax [2]. This means the South African taxpayer is paying for the healthcare bill of tobacco-related harm while the tobacco industry collects the profits. The only way to change this scenario is to substantially increase excise taxes on tobacco. In 2018, the finance minister increased the tobacco excise tax by just R1.22 for a pack of 20 cigarettes [3]– this translated to an increase of a mere R2.50 for someone who smokes two packets a week. Although this increase was in line with the CPI, it did little to reduce the affordability of cigarettes. And this small increase will not encourage a drop in consumption. The tobacco industry has constantly exaggerated the size of the illicit trade to put false pressure on tobacco tax policy. But 2014 research by UCT’s Professor Corne van Walbeek shows that the tobacco industry has been adjusting its estimates of the illicit trade to create the illusion that it has been rapidly growing [4]. Although he agrees that illicit trade exists, he says that if previous estimates by the tobacco industry were incorrect, the credibility of current estimates should be questioned. Illicit trade in South Africa can only be tackled through enforcement. This primarily comes from the criminal justice sector. But the Hawks and the National Prosecuting Authority have been in disarray and the South African Revenue Service has deliberately been undermined. As a result, enforcement has not taken place, particularly in the last six years. The long-term solution for South Africa is to implement the World Health Organisation’s Illicit Trade Protocol [5]. This calls for the use of an independent and effective system that regulates cigarette production, import, export and sale. South Africa signed the Protocol in 2013 [6] but has still not ratified or taken steps to implement it. What can be done? Prevention costs less than treatment. Prevention means reducing the number of smoker- and one of the most effective ways to do this is to increase the price of tobacco. This is how we can take back the tax that is spent on tobacco-related health harm. We call on the National Treasury to increase the excise tobacco tax to 70% of the current price of cigarettes and other tobacco products. This has been recommended by both the World Health Organisation and the World Bank [7]. It would make cigarettes more expensive and reduce consumption. And it will send a clear message to the tobacco industry that their attempts to undermine evidence-based healthy public policy are not successful. Tobacco taxes are a win-win for public health and public finances. References [1] The Tobacco Atlas - South Africa [2] BAT revenue rises but profit and market share fall. Robert Laing for Bizcommunity 28 JUL 2017 | [3] 2018 Budget Speech by Malusi GigabaMinister of Finance 21 February 2018 [4] Are the tobacco industry's claims about the size of the illicit cigarette market credible? The case of South Africa. 2014 Corné van Walbeek, Lerato Shai [5] WHO Protocol to Eliminate Illicit Trade in Tobacco Products [6] SA signs tobacco smuggling treaty. IOL, 11 JANUARY 2013 [7] TAXING TO PROMOTE PUBLIC GOODS: TOBACCO TAXES. World Bank1,561 of 2,000 SignaturesCreated by National Council Against Smoking

-

Title deeds for the deserving residents of Pennyville flatsThe majority of people living in Pennyville are currently either unemployed or the families are child run or elderly run with most receiving grants. Most of them cannot afford the rentals and therefore in arrears amounting to thousands of rands. Attempts to address this matter with the relevant authorities have been unsuccessful.59 of 100 SignaturesCreated by Thabiso Seipobi

-

Tell MTN to stop stalling #DataMustFall#DataMustFall got ICASA, the communications regulator, to introduce new rules that stop networks from chowing airtime when your bundle runs out, and making your data expire. But 24 hours before networks had to implement ICASA’s the new rules, Cell C made an urgent application to the court to stop the new ICASA regulations. MTN has joined Cell C in this action. ICASA has pushed back [1], but needs our help in creating public pressure to save millions of Mzansi’s people who continue to be pick pocketed by networks. Will you call on MTN to drop the legal action and comply with ICASA’s regulations? Recently, MTN announced a 200% data price increase [2]. It is hardly surprising that MTN are stalling the ICASA regulations given share prices have dropped by 53% over three years [3] They are trying to use the poor to maintain their profit margins and make returns for their shareholders. We know that MTN are merely stalling the regulations with this legal action- and we can beat them. Already, thousands of people across Mzansi joined the #DataMustFall campaign, and made submissions to ICASA on how these ridiculously high data prices affect them. Our actions resulted in regulations that will allow us to carry over unused data and not be charged high out-of-bundle rates without consent. With each month that passes without these regulations coming into effect, more money is robbed from our pockets. If we apply enough pressure on MTN as its customers, we could force them to back off this legal action and comply with the ICASA regulations. By emailing the CEO of MTN about his network’s actions, we will expose them to public scrutiny, creating a public backlash that could force them to drop their legal action. Will you sign? [1] ICASA Notes Cell C's Urgent Application To Review The Eussc Regulations. 7 June 2018. [2] Fans ready to cancel MTN after 200% data bundle price increase, Kyle Zeeman for TshisaLive. 17 July 2018. [3] SA telecoms shares come tumbling down, Tech Central. 27 June 2018.378 of 400 SignaturesCreated by Amandla.mobi Member

-

Tell Vodacom to implement ICASA rules to make data last#DataMustFall got ICASA, the communications regulator, to introduce new rules that stop networks from chowing airtime when your bundle runs out, and making your data expire. But 24 hours before networks had to implement ICASA’s the new rules, Cell C made an urgent application to the court to stop the new ICASA regulations just hours before they were meant to be implemented. MTN and Telkom have joined Cell C in this action. ICASA has pushed back [1], but needs our help in creating public pressure to save millions of Mzansi’s people who continue to be ripped off with high data prices. While it doesn’t appear that Vodacom have joined MTN, Cell C and Telkom in taking legal action against ICASA over the regulations, they are benefiting from the regulations being delayed. Let’s demand Vodacom show leadership and implement the regulations. Will you call on Vodacom to immediately comply with ICASA’s regulations? The people of Mzansi voiced how they were affected by high data costs charged by the likes of Vodacom and other service providers. The Independent Communications Authority of South Africa (ICASA), after public hearings, published End-User and Subscriber Service Charter Regulations which were meant to come into effect on 8 June 2018, relieving the enormous data costs we all face. It's not surprising networks want to undermine ICASA so our Data Must Fall campaign isn't successful. They have a lot to lose should the regulations be implemented. Last year, Vodacom reported that they make R2 billion per month from data alone [2]. Research shows that low income consumers are paying disproportionately high charges, and are not seeing benefits of competition in comparison to high income consumers who are able to buy larger quantities of data [3]. [1] ICASA Notes Cell C's Urgent Application To Review The Eussc Regulations. 7 June 2018. [2] Vodacom now makes R2 billion per month from data, My Broadband. Jan 31, 2018. [3] Izolo: mobile diaries of the less connected, Research report by Making All Voices Count. 20 Nov 2017. [4] MTN, Vodacom charging up to 2 639% more for out-of-bundle data - report, Kyle Venktess for Fin24. 12 march 2018.526 of 600 SignaturesCreated by Amandla.mobi Member

.png)

.png)

.png)

.png)

.png)